Many questions are always asked by our clients such as “should I set up a Self-Managed Super Fund” or “can I benefit from a SMSF?”

There’s a lot of factors to consider about super funds but to start there are 3 options available to you which include retail, industry, or Self- Managed Super Fund. It’s easy to get lost in the specifics but we aim to make it easy for you to navigate your way through the jargon and find the right option for you.

We want to give you the best advice tailored to your goals so it’s important to weigh up the advantages and disadvantages of each option.

What is a self-managed super fund?

A Self-Managed Super Fund (SMSF) is a superannuation trust that has the main purpose of providing retirement benefits to the members, in these funds the members themselves act as trustees this means that the members control and run the superfund.

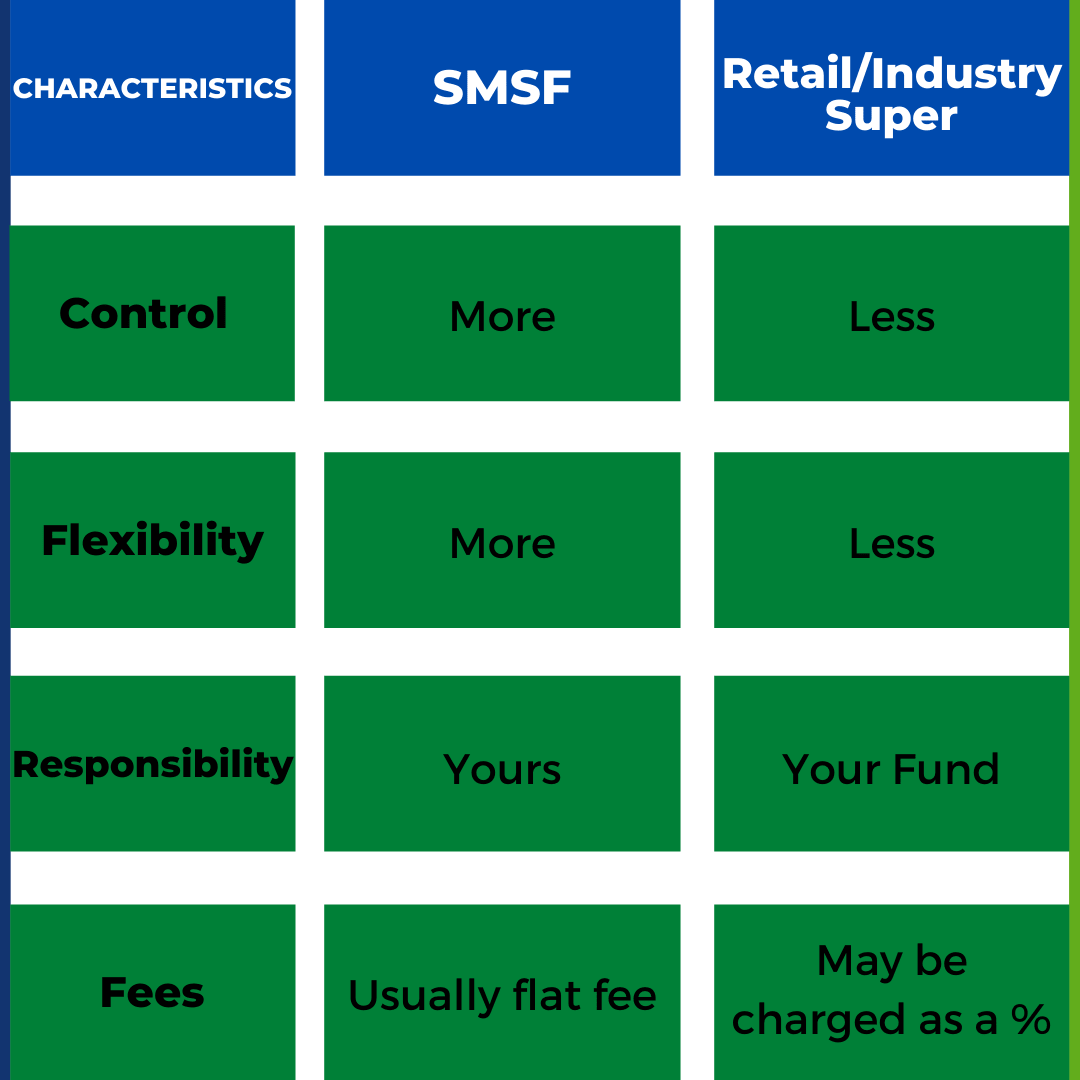

Differences between retail, industry, and SMSF

Benefits of a SMSF

It’s easy to see why a SMSF can be beneficial to you as it allows for greater freedom and control to suit your situation. The large degree of flexibility and control over your investments puts you in the driver’s seat and offers a various range of additional options to invest in for example direct property (Commercial or Residential). This hands-on system means as the market changes you can adjust your investment portfolio swiftly to reflect the changes. This high-level of control can be life-changing when you factor in the lifestyle you want to live and the goals you have set out for yourself. Taking control of your super fund during your retirement can be one of the best decisions if you’re proactive with it.

Another significant benefit associated with an SMSF includes effective tax management, In a SMSF you have more control over assets and investment decisions which can allow you to be in a better position when it comes to taxes for your SMSF. 15% is the current tax rate on superannuation fund earnings but if the income is produced by assets wholly supporting an income stream such as a pension there is no tax payable within the fund on that income. This can mean you may be able to reduce or eliminate a capital gains tax liability.

Drawbacks of a SMSF

As there are countless benefits from a SMSF there are a few factors that may steer you away from them.

Some responsibilities which may deter someone include:

- Lodging annual tax returns

- Time-consuming

- Having a clear investment strategy

A lot of these responsibilities can be given over to professional accountants & advisors who can steer your investment strategy in a clear path and help you get the most from your SMSF.

Still Unsure?

If you’re still scratching your head wondering whether a Self-Managed Super Fund is the right option for you, don’t hesitate to get in contact with our super helpful team to further shed some light on your situation.

With the freedom and control that a SMSF can provide for your investments and wealth, it’s important to fully understand what you’re getting yourself into, thus if you need answers and want to take the first step towards gaining control of your finances contact our team at Zimsen Partners.