Key tax requirements for your company, and how they work

In terms of business structures, expect your tax requirements as a company to be far greater. Tax on profits, any capital gains made, your goods and services rendered, employee benefits, and even your payroll are just some of the taxes you will encounter as an Australian company.

There are many company tax obligations that may fluster you but Zimsen Partners can make the daunting process feel seamless. If you wish to discuss the tax requirements applicable to your company don’t hesitate to contact us today.

Profit tax for companies

The most well-known tax is the company tax on profit. This tax will carry two tax rates for companies that are residents of Australia. It is important to note that companies that fall into this category are subject to Australian income tax on their worldwide income.

That being said it’s crucial to know if your company classifies as a small business as the turnover threshold is $10 million.

- Small businesses with an annual turnover of less than $10 million, will face a tax rate of 27.5%.

- Companies exceeding an annual turnover of $10 million receive the full tax rate of 30%.

Your company has an obligation to pay these company tax rates. In regards to profits, each financial year your company will determine profits based on your sales, minus any expenses, and wages you’ve paid yourself.

With the profits, you have two options which involve keeping the funds within the business to grow future progress and expand or distribution to the company shareholders

Case Study

Your business made $750,000 in sales for the financial year. Don’t forget you also spent $150,000 on expenses, and another $150,000 on wages. Doing the math that will leave you with $450,000 in profit.

We now know the profit of this company will be taxed at 27.5%

A quick calculation will show that your company is obligated to pay $123,750 in company tax.

The remaining $326,350 can be kept in the business or distributed to shareholders as dividends.

GST

Everyone has come across Goods and Services Tax (GST) in their lifetime. This tax is a flat 10% tax that’s added to the supply of certain goods and services.

Conditions you must register for GST:

- Business turnover is $75,000 or more within a 12-month period.

- Not-for-profit organisation with a business turnover of $150,000 or more within a 12-month period.

- Taxi or ride-sourcing service.

Usually, the GST amount will be added to your prices then passed on to your consumers. There are also some goods and services that are considered GST-free.

These are things like basic foods, healthcare products and services, and medical products and services.

To avoid any confusion, contact an expert tax accountant who can give you surety when it comes to your specific company.

Capital Gains Tax (CGT)

According to the Australian Tax Office, a capital gain or capital loss on an asset is the difference between what it cost you and what you receive when you dispose of it.

This may include things like a vehicle, or a property that’s used by the business and much more.

You pay tax on your capital gains, which forms part of your income tax and is not considered a separate tax – though it’s referred to as CGT.

Case study

You purchase an investment property for $400,000, and your upfront costs/expenses (legal fees, stamp duty, etc.) are $16,500. You sell the property four years later for $600,000.

Your capital gain would be $216,000. You’re now required to pay tax on that $216,000 capital gain you made from this sale.

Fringe Benefits Tax (FBT)

Any fringe benefits provided to you and/or your family by your employer will incur them a Fringe Benefits Tax (FBT).

FBT is separate from your income tax. It’s calculated on the taxable value of a fringe benefit. The taxable value is generally the cost to your employer of providing the benefit to you.

What are some fringe benefits?

- A leased vehicle for your personal use (under a ‘novated lease’ arrangement)

- Personal use of a company car

- Discounted loans

- Gym/health memberships

- Entertainment expenses – free/discounted food, cinema tickets, accommodation

- Private health insurance

- Living-away-from-home allowance (LAFHA)

- Real Property – land and buildings

- Right to Property – shares, bonds

- Childcare costs and school fees

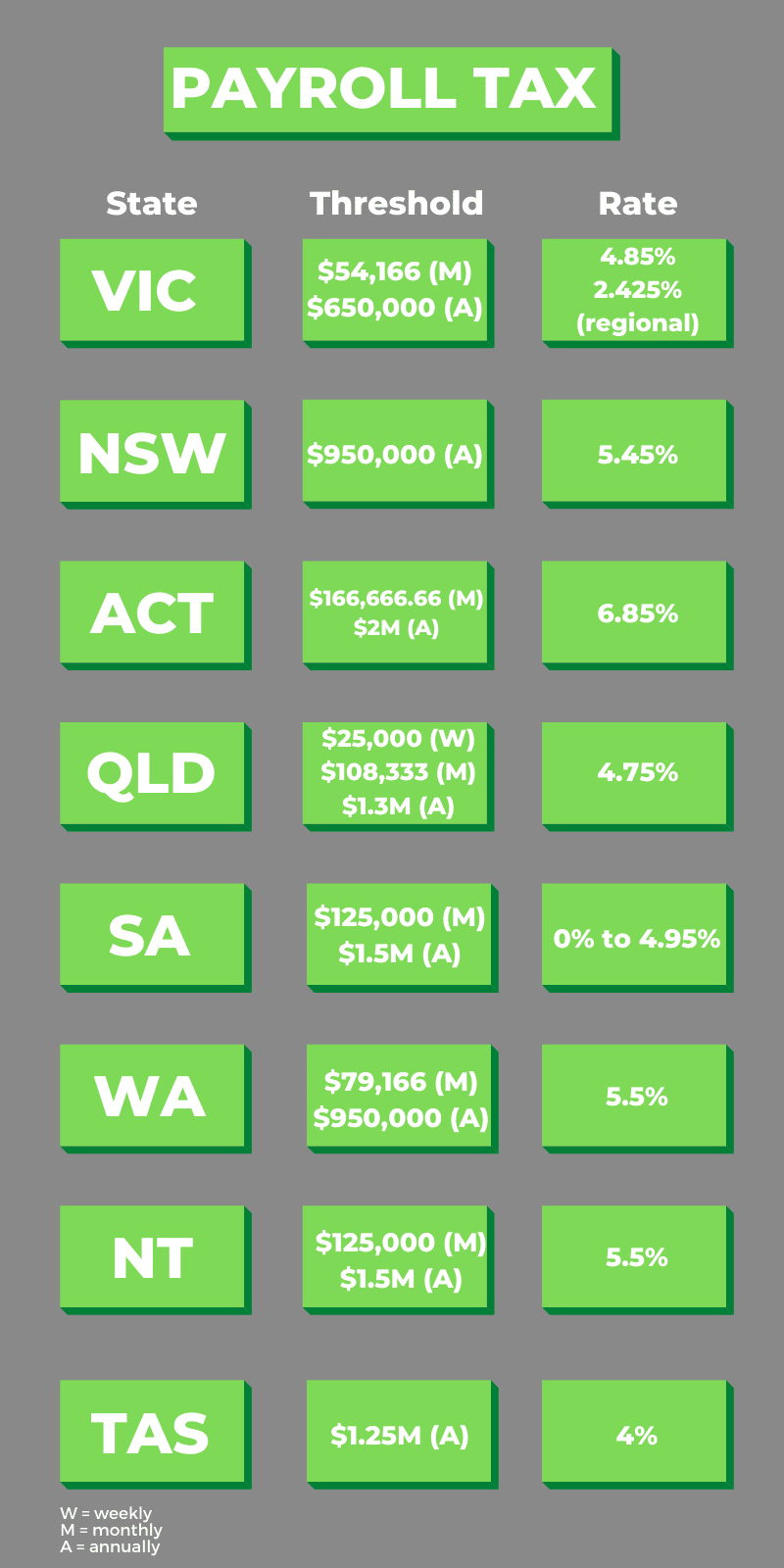

Payroll tax

Payroll tax is a self-assessed tax which will be determined by the value of the wages you provide to your employees. If your company exceeds the threshold amount you will incur the Payroll tax which varies in each state.

A payroll tax return will have to be lodged and paid to your state’s respective revenue office if you exceed the following thresholds and can be paid monthly, quarterly, or annually.

The following table reveals all payroll tax rates and thresholds within Australia:

Conclusion

With many tax requirements and obligations, it is paramount that your company is on top of their tax compliance. With just a few named we weren’t able to go through a complete and comprehensive list as the situation and activities of each business may vary bringing forth further state & territory taxes.

Furthermore to ensure your company is well-suited to handle these obligations you should seek a registered Zimsen Partners tax accountant who can guide you through meeting all these requirements. Contact us today to get a head start in setting up your company for success.