Important Tax Tips for Australian Small Businesses in 2020

June 10, 2020

Tax filing is that time of the year when most businesses are at their wit’s end. While some businesses may lay confidently due to organised books and complete financial awareness, a lot may be under stress. Most businesses are seen scrounging for past receipts and reading up on the latest tax deductions at the last…

Read MoreProvisions by the Australian Government to Ease the COVID-19 Financial Crisis

May 12, 2020

The Coronavirus Pandemic has become a major concern for economies worldwide. It is a double edged sword which is affecting both financial as well as health status of nations. Moreover, due to the uncertainty attached, mental, physical and economical stability have all become a matter of concern. In such a bleak situation, global governments are…

Read MoreThe JobKeeper Payment

April 1, 2020

Close to the end of the working day on Monday 30 March, the Federal Government announced the introduction of a new JobKeeper Payment to assist eligible employers (and self-employed individuals) who have been impacted by the Coronavirus pandemic to continue paying their workers. The following is a broad summary of the key aspects of the…

Read MoreThe Government’s Stimulus Package and What You Need to Know

March 24, 2020

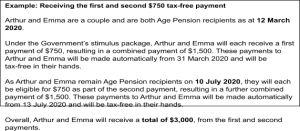

The following is a broad summary of the key aspects of the Federal Government’s stimulus package set out by the Treasury and the NTAA. 1. Income support for individuals 1.1 Introducing a new Coronavirus supplement The Government has introduced the payment of a new Coronavirus Supplement of $550 per fortnight to eligible individuals receiving certain…

Read MoreVictorian Government Assistance Package To Support Local businesses And The Community

March 23, 2020

The Victorian Government released details of a $1.7 billion support package for local businesses that was prepared in coordination with the Treasury over the weekend. The Government also indicated that the Victorian 2020-21 budget will be differed in line with the Federal Government budget due to the uncertainty caused by the virus pandemic. The package…

Read MoreGovernment Stimulus to assist with Business Cashflow

March 19, 2020

With the number of Coronavirus cases growing daily, companies are becoming increasingly concerned and fearful of the damaging consequences the outbreak will have with many businesses already experiencing cash flow difficulties. With the virus now worsening and directly impacting business here in Australia most businesses are experiencing a tightening in cashflow as supply chains collapse…

Read MoreA Basic Guide to Bookkeeping for Small and Medium Businesses

March 17, 2020

Every business, no matter the size, needs effective bookkeeping. However, if yours is a small or medium business, it’s a possibility that you are a newcomer. A constructive bookkeeping process will ensure that you stay at the top of your business finances, being able to make better gains and utilise your funds in the best…

Read MoreHow to Identify Market Opportunities for Business Growth

February 21, 2020

The global economy has always been volatile, however modern day technologies and scientific advances have shortened the life cycles of various products and services, disrupting the traditional business model, and giving rise to more competition. In this scenario of constant competition and instability, it becomes all the more important to seek out fresh business opportunities…

Read MoreHow to Make this Festive Season FBT Friendly

December 6, 2019

The Christmas season is here! Festive celebrations, gifts and entertainment become common occurrences at the workplace during this time of year. However, most employers get a shock during the annual audit toward the end of the financial year, as they realise the overall cost of gifts and partying doubled up due to the Fringe Benefit…

Read MoreExpanding Your Business to Asia? Here Are a Few Key Considerations

November 7, 2019

With a staggering population of over 4.4 billion spread across over 50 countries, Asia has a distinctly diverse business landscape. Naturally, they are one of the most favoured consumer markets for international businesses. The diversified market and business environment are undoubtedly untapped goldmines; however, it has its own set of challenges. Its divergent nature makes…

Read MoreTick these Crucial Checkboxes For a Profitable Business Expansion

October 9, 2019

Did you know small and medium sized enterprises (SMEs) have the lion’s share in Australia’s GDP? According to a report, small businesses form the backbone of the Australian economy with a colossal contribution of 57% to its annual GDP and 7 million job generation. Owing to favourable market conditions and increasing investments, the SME sector…

Read MoreTake Charge of Cash Flow In Your Business with These Tips

August 30, 2019

It is no secret that insufficient and poorly managed cash flow can cripple even the most profitable businesses. According to a new study from Wakefield Research, commissioned by Intuit Australia, small businesses in Australia have lost opportunities worth $5.8 billion due to inadequate cash flow. It is essential to take control of your cash flow to…

Read More